- Startup Inbox

- Posts

- 2025 Annual Report: $924.8M Raised, Fewer Deals—Stronger Rounds

2025 Annual Report: $924.8M Raised, Fewer Deals—Stronger Rounds

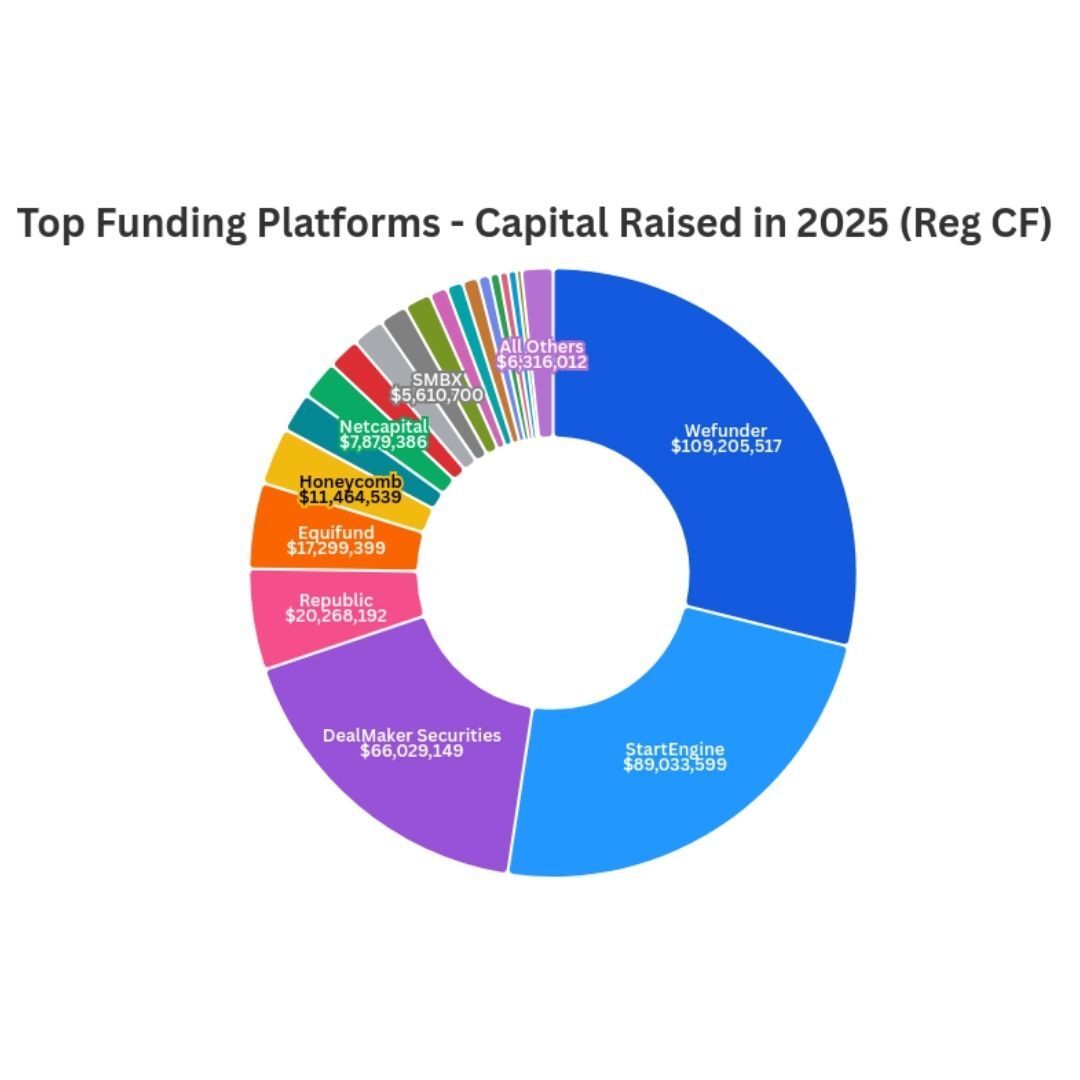

Investment crowdfunding rebounded 58% YoY. Despite 29% fewer new Reg CF offerings, dollars still climbed 11% to $378.3M with 101 $1M+ raises and nine at the $5M cap—proof that traction + distribution win.

CHART OF THE WEEK

By Brian Belley \ Read

2025 was a rebound year for investment crowdfunding — total capital raised across Reg CF + Reg A+ climbed 58% YoY to $924.8M. Reg CF, in particular, tells an encouraging founder story: even with 29% fewer new offerings, the market still grew 11% to $378.3M raised, signaling that investors concentrated dollars into fewer, stronger campaigns (including 101 Reg CF raises over $1M and 9 that effectively hit the $5M cap). If you’re fundraising this year, the takeaway is clear: traction + distribution matters more than ever — and the capital is still there for well-executed raises.

See the full charts, platform breakdowns, and 2026 takeaways in our 2025 Annual Report

Have questions about your own status? Ask our raisepapers (a Kingscrowd company) team of Filing and Compliance Specialists (FCS) at [email protected]

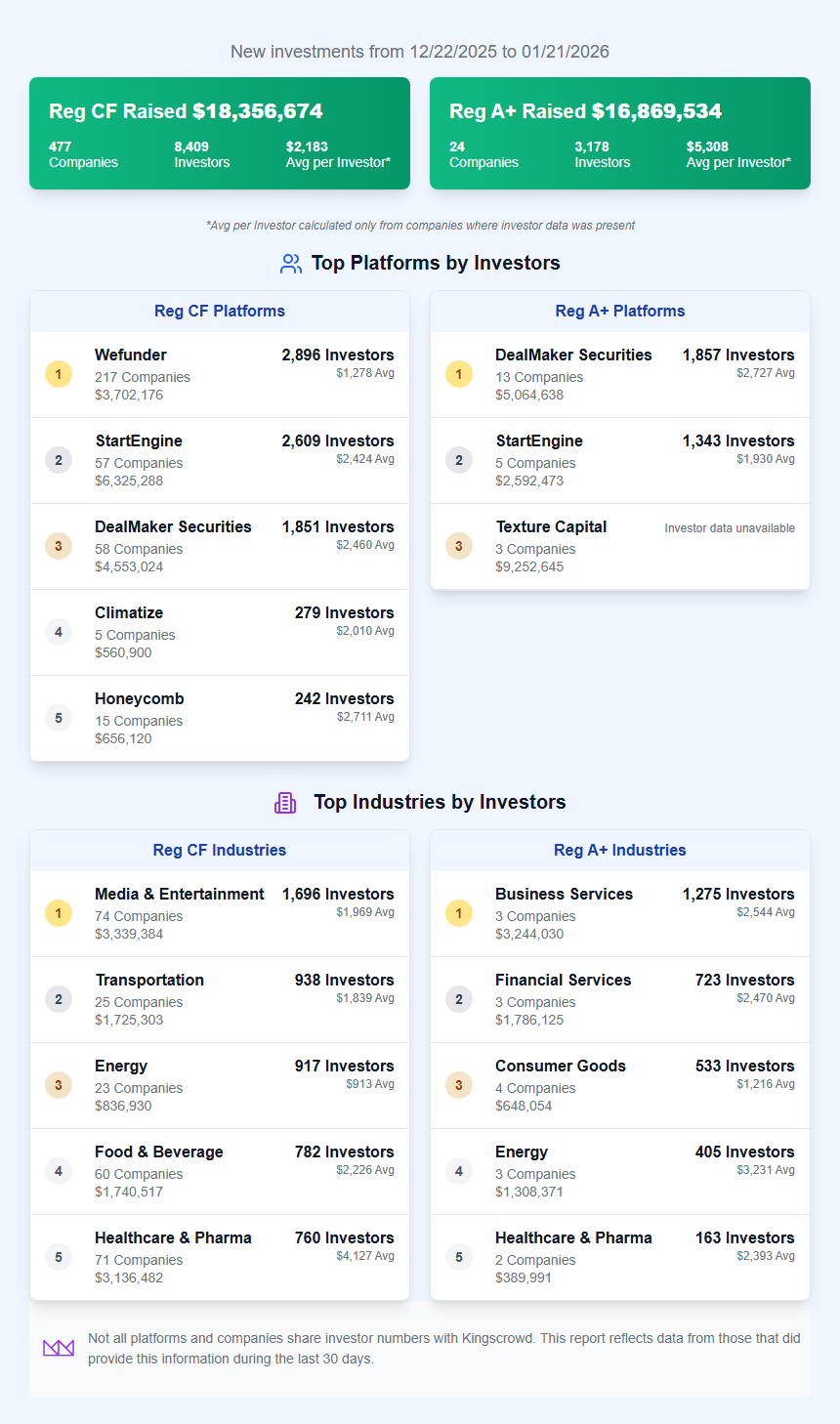

Funding Market Pulse (Dec 22–Jan 21)

The crowd put $18.4M to work via Reg CF and $16.9M via Reg A+. StartEngine and DealMaker led CF by dollars while Wefunder owned breadth; Healthcare & media topped CF sector flows, and Business Services/real assets drove Reg A+. See the platform-by-platform stats and sector movement.

Monthly Snapshot: By the Numbers

Reg CF committed: $18.36M across 477 companies from 8,409 investors (avg check $2,183 where investor data is available).

Reg A+ committed: $16.87M across 24 companies from 3,178 investors (avg check $5,308 where investor data is available).

Top CF platforms by amount raised: StartEngine $6.33M (57 companies; avg check $2,424), DealMaker Securities $4.55M (58; $2,460), Wefunder $3.70M (217; $1,278). Others: Honeycomb $0.66M, Climatize $0.56M, Equifund $0.50M, Republic $0.24M.

Top A+ platforms by amount raised: Texture Capital $9.25M (real estate & other), DealMaker Securities $5.06M (13 issuers; avg $2,727), StartEngine $2.59M (5; $1,930).

Leading CF sectors by dollars: Healthcare & Pharma $3.14M (71 companies; avg $4,127), Media & Entertainment $3.34M (74; $1,969), then Transportation $1.73M, Food & Beverage $1.74M, Industrial Services $1.43M, Real Estate $1.06M.

Leading A+ sectors by dollars: Business Services $3.24M, Energy $1.31M, Financial Services $1.79M; Real Estate dominated via a single large line item under A+ tracking.

Was this Investor Report Helpful? |

EDUCATION

Reg CF SPVs: a C-AR reporting wrinkle

CrowdCheck flags a surprising consequence of using a Reg CF SPV: even though the SPV and the company are treated as “co-issuers,” current market practice often counts the SPV as one holder of record—potentially allowing reporting to end sooner via Form C-TR than many founders (and investors) expect. That can mean fewer annual Form C-AR updates reaching the underlying investors, even when hundreds participated through the SPV. If you’ve used (or are considering) an SPV structure, this is worth understanding before C-AR season hits.

UPCOMING EVENTS

DealFlow Discovery Conference Adds New Reg A Fundraising Workshop

The DealFlow Discovery Conference, returning January 28-29, 2026 at the Borgata Hotel in Atlantic City, NJ, continues to expand its focus on emerging capital-raising strategies for growth-stage companies.

Now in its third year, the Discovery Conference has become one of the largest gatherings in the microcap and alternative investing ecosystem, bringing together public and private companies, investors, analysts, and advisors for two days of presentations, one-on-one meetings, and market-focused discussions. Attendance is expected to exceed 1,000 participants, with more than 100 companies already confirmed to present.

New for 2026, the conference will introduce a dedicated Regulation A Fundraising Track, anchored by a hands-on Reg A workshop hosted by DealMaker. The workshop will be followed by live presentations from companies currently raising capital under Regulation A, giving attendees a practical look at how issuers are structuring offerings and engaging investors in today’s market.

The Reg A track is designed to serve both issuers exploring alternative fundraising strategies and investors seeking opportunities outside traditional IPO and venture channels. Participation in the Reg A presentations is limited to Regulation A issuers, with space available on a first-come basis.

StartEngine IRA 101 Join us Wed, Jan 28 at 1pm ET for a free webinar with StartEngine and Equity Trust on how to use a self-directed IRA to access private-market opportunities. We’ll cover IRA setup/rollovers, portfolio allocation basics, and how pre-IPO investing can work with retirement dollars—plus live Q&A. |

Equity Crowdfunding Tactics with Potomac Growth Kingscrowd CEO Chris Lustrino will host a fireside chat with Eitan Charnoff, Founder & CEO of Potomac Growth, on what actually drives successful equity crowdfunding campaigns for founders and issuers. They’ll dive into realistic raise targets, network activation, and investor acquisition tactics you can use across platforms like StartEngine, Wefunder, and Dealmaker. |

EVALUATE YOUR STARTUP OPPORTUNITY

Know Your Company’s Worth in Seconds.

Stop guessing what investors think—get an objective, data-driven valuation in minutes with Kingscrowd’s Startup Valuation Tool. Plug in a few key metrics, see how you stack up against 7,000+ online raises, and walk into your next pitch with confidence. Ready to benchmark your company’s true market value? Try the valuation tool for free.

INSIDE STARTUP INVESTING

Build with the why, not just the data.

This week on Inside Startup Investing, Solsten CEO Joe Schaeppi breaks down how their cognitive-behavioral AI turns real psychology into higher-converting creative and product experiences—often delivering 3× conversion and lower CPIs. We dig into validating deep tech, privacy-first data collection, and the GTM shift from R&D to scale.