- Startup Inbox

- Posts

- Final Disclosures Are Slipping—And Why It Matters

Final Disclosures Are Slipping—And Why It Matters

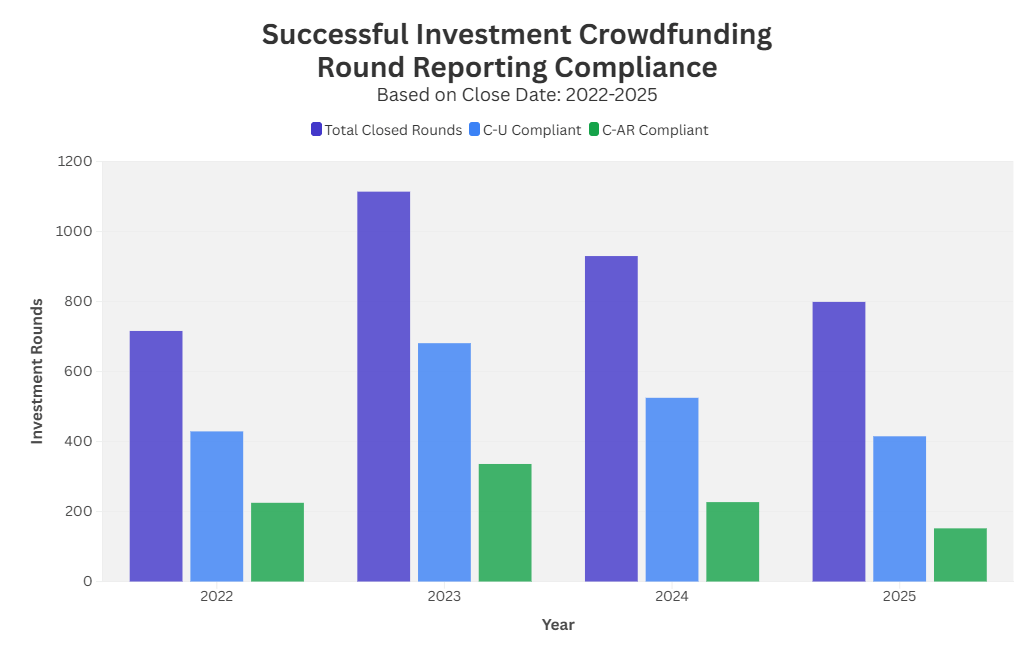

Form C-U has dipped to ~52% and C-AR to ~19% of closed rounds in 2025. What falling compliance signals to investors—and how founders can stay ahead.

Editor’s Note: Kingscrowd Pro is here. Offering platforms, agencies, and advisors faster prospecting tools and streamlined client fundraising reporting through Pro Search, the Client Tracker dashboard and more.

CHART OF THE WEEK

By Chris Martin \ Read

Final Disclosures & Annual Reports

In accordance with U.S. Securities and Exchange Commission (SEC) rules governing Regulation Crowdfunding, a company is required to file a Final Disclosure (Form C-U) to report the total amount of securities sold no later than five business days after closing its crowdfunding offering.

Additionally, issuers must file an Annual Report (Form C-AR) within 120 days of the end of their fiscal year for each year in which they have outstanding Regulation Crowdfunding securities.

Looking at successful rounds by the close of the year, the data shows a clear drop-off in ongoing reporting over time. While Form C-U compliance has remained relatively steady, with about 60% of closed rounds filing in 2022 (59.9%) and 2023 (61.1%), that rate slips in more recent years to 56.5% in 2024 and 51.9% in 2025. The decline is more pronounced for Form C-AR, falling from 31.4% of closed rounds in 2022 and 30.2% in 2023, to 24.4% in 2024 and just 19.0% in 2025.

Have questions about your own status? Ask our raisepapers (a Kingscrowd company) team of Filing and Compliance Specialists (FCS) at [email protected]

Founder Market Pulse (Dec 8–Jan 7)

Investors put $22.1M to work via Reg CF and $37.2M via Reg A+. DealMaker and StartEngine led on dollars while Wefunder owned breadth; Healthcare, media, and industrial topped CF sector flows, and Business Services dominated A+. Dive into the platform-by-platform stats, sector heat, and what it means for your next round

Monthly Snapshot: By the Numbers

Reg CF capital committed: $22.10M across 500 companies from 9,847 investors (avg check $2,245 where investor data was available).

Reg A+ capital committed: $37.16M across 24 companies from 13,777 investors (avg check $2,697 where investor data was available).

Top Reg CF platforms by amount raised: DealMaker Securities $6.83M (58 cos.), StartEngine $5.36M (63), Wefunder $4.83M (222), Republic $1.71M (11); Equifund posted $1.06M from 2 issuers.

Top Reg A+ platforms by amount raised: DealMaker Securities $29.50M (13 issuers), StartEngine $4.32M (5), Texture Capital $3.37M (3).

Leading Reg CF sectors by $: Healthcare & Pharma $4.11M (72 cos.), Media & Entertainment $3.32M (75), Industrial Services $3.01M, then Food & Beverage $1.88M, Transportation $1.52M, Energy $1.44M.

Leading Reg A+ sectors by $: Business Services $28.04M, followed by Consumer Goods $2.79M, Financial Services $1.44M, Energy $0.96M.

UPCOMING EVENTS

Equity Crowdfunding Tactics with Potomac Growth Kingscrowd CEO Chris Lustrino will host a fireside chat with Eitan Charnoff, Founder & CEO of Potomac Growth, on what actually drives successful equity crowdfunding campaigns for founders and issuers. They’ll dive into realistic raise targets, network activation, and investor acquisition tactics you can use across platforms like StartEngine, Wefunder, and Dealmaker. |

StartEngine IRA 101 Join us Wed, Jan 28 at 1pm ET for a free webinar with StartEngine and Equity Trust on how to use a self-directed IRA to access private-market opportunities. We’ll cover IRA setup/rollovers, portfolio allocation basics, and how pre-IPO investing can work with retirement dollars—plus live Q&A. |

EVALUATE YOUR STARTUP OPPORTUNITY

Know Your Company’s Worth in Seconds.

Stop guessing what investors think—get an objective, data-driven valuation in minutes with Kingscrowd’s Startup Valuation Tool. Plug in a few key metrics, see how you stack up against 7,000+ online raises, and walk into your next pitch with confidence. Ready to benchmark your company’s true market value?

INSIDE STARTUP INVESTING

How a spirits tech company pivoted globally

This week on Inside Startup Investing, Cleveland Whiskey CEO Tom Lix breaks down a resilient pivot: pressure-aging tech that makes whiskey in hours, a move from stagnant U.S. shelves to India’s booming market with high-margin concentrates, and a capacity build to 45k sq. ft. Founders will appreciate the playbook on navigating tariffs, shortening cycles, and structuring international JVs—plus why candid investor updates matter when the market turns.