- Startup Inbox

- Posts

- Founder Market Pulse: $24.5M Reg CF, $17.3M Reg A+ (Oct 21–Nov 20)

Founder Market Pulse: $24.5M Reg CF, $17.3M Reg A+ (Oct 21–Nov 20)

DealMaker led by dollars, Wefunder by deal count; entertainment tops CF while energy & industrial drive A+.

Founder Report (Oct 21–Nov 20)

The investing crowd put $24.5M to work via Reg CF and $17.3M via Reg A+. DealMaker led by dollars (in both CF and A+), Wefunder led by deal count, and Media & Entertainment again topped the CF sectors—with Energy and Industrial driving A+. See the platform-by-platform stats, sector heat, and what it means for your next round.

Monthly Snapshot: By the Numbers

Reg CF capital committed: $24.52M across 520 companies from 11,776 investors (avg check $2,082 where investor data is available).

Reg A+ capital committed: $17.28M across 22 companies from 5,852 investors (avg check $2,952 where investor data is available).

Top CF platforms by $ raised: DealMaker Securities $7.64M (52 cos.; avg check $2,811), Wefunder $7.08M (209; $1,620), StartEngine $5.87M (65; $1,857), then Republic $0.98M (13) and Honeycomb $1.01M (37).

Top A+ platforms by $ raised: DealMaker Securities $13.71M (10 cos.), StartEngine $2.46M (5); smaller totals across Texture, Rialto, and others.

Leading CF sectors by $: Media & Entertainment $7.18M (77 cos.), Food & Beverage $2.73M (81), Transportation $2.57M (24), Healthcare & Pharma $2.08M (65), Energy $1.56M (32).

Leading A+ sectors by $: Energy $7.59M, Industrial Services $4.00M, Financial Services $1.68M (smaller but notable: Alcohol & Tobacco $1.64M).

Was this Investor Report Helpful?Would you like to see more reports in the future? |

COMPLIANCE HELPS GROW THE INDUSTRY

Stay compliant. Save money.

At the latest CfPA Summit, SEC Commissioner Hester Peirce just reminded the industry: when issuers skip required disclosures (like Form C-AR), it hurts investors—and it makes regulatory improvements harder to win. If you raised under Reg CF or Reg A, now’s the time to button up your filings.

raisepapers will review and prep your required updates (Form C-AR, Reg A ongoing reports), sanity-check financials, and make sure your disclosures are complete and on time.

Limited offer: Get $200 off compliance services with code COMPLIANCE.

UPCOMING EVENTS

FOUNDER WORKSHOP: FROM IDEA TO PAYING CUSTOMERS

Zero to First Customers: Founder Frameworks That Actually Work

On December 4th at 3pm ET, join serial entrepreneur and founder coach James Sinclair for a live, tactical workshop on validating your idea, designing an MVP, and getting your first paying customers—based on the frameworks from his new book Starting a Startup: Build Something People Want. Live attendees will have the chance to win 1 of 10 copies of the book plus a 1:1 coaching session with James, so this is one session you’ll want to show up to in real time.

Citizens Coffee Investor Q&A Join Kingscrowd Capital and Citizens Coffee CEO Justin Giuffrida for a candid look at channel strategy, unit economics, and the 2026 growth plan—plus live audience Q&A. Save your seat to attend live or get the replay. |

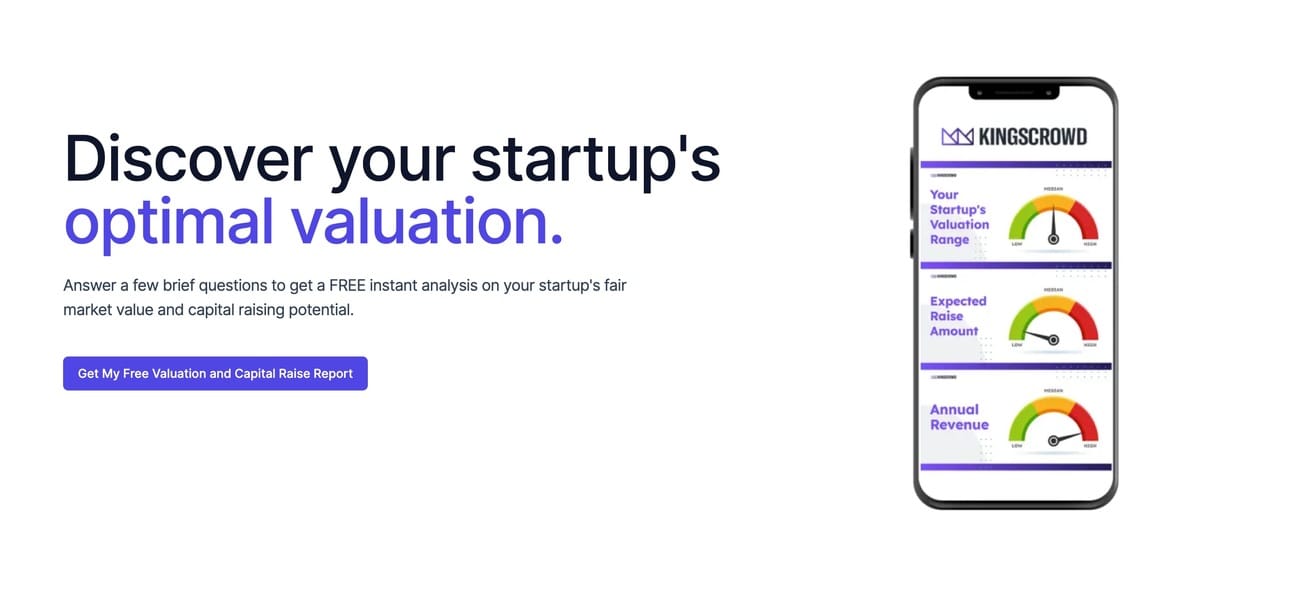

EVALUATE YOUR STARTUP OPPORTUNITY

Know Your Company’s Worth in Seconds.

Stop guessing what investors think—get an objective, data-driven valuation in minutes with Kingscrowd’s Startup Valuation Tool. Plug in a few key metrics, see how you stack up against 7,000+ online raises, and walk into your next pitch with confidence. Ready to benchmark your company’s true market value?

INSIDE STARTUP INVESTING

This Week on Inside Startup Investing

A textbook category build: source for quality, mill for flavor/nutrition, win the pros, then scale capacity. Cairnspring Mills shows how craft + operations discipline can outgrow a legacy market—and why regional at scale can be a durable moat.

NEWS & NOTES

SEC 2025 Exams: What Funding Portals Need to Fix Now

CrowdCheck’s Andrew Stephenson breaks down the SEC’s 2025 examination priorities for funding portals—from escrow arrangements and recordkeeping to new Reg S-P incident response and data security requirements—so founders and platforms can benchmark how compliant their portal partners really are. Read the post here.