- Startup Inbox

- Posts

- Funding Report (November 2025): A Steady, Broadly-Participating CF Market

Funding Report (November 2025): A Steady, Broadly-Participating CF Market

$21.4M in Reg CF commitments amid low failure rates and healthy long-tail participation. DealMaker ($6.35M) and StartEngine ($5.33M) led by dollars, while Wefunder hosted 207 active raises. Read the full breakdown and platform implications for December.

Funding Report (November 2025)

November 2025 closed with $21.4 million in Reg CF commitments, marking a modest but steady month for the crowdfunding ecosystem. Activity was concentrated among the largest platforms, with DealMaker Securities and StartEngine together driving over half of all investor commitments, while Wefunder continued to dominate in the number of active campaigns. Although total dollars raised were lower than recent late-summer peaks, the market showed broad participation across platforms and sectors. Most raises this month remained active heading into December, and platform-level data indicates relatively few failed rounds, suggesting stable investor engagement despite seasonal slowdowns.

Monthly Snapshot: By the Numbers

Total Net Commitments: Investors placed $21.41M across Regulation Crowdfunding campaigns during November.

Top Dollar Performer: DealMaker Securities led with $6.35M, followed by StartEngine at $5.33M, together accounting for nearly $12M in commitments.

Largest Active Pipeline: Wefunder hosted 207 active raises, far exceeding any other platform, and still contributed $4.48M despite its smaller average raise size.

Low Failure Rates: Most platforms reported zero or very few failed rounds, indicating that campaigns largely remained viable throughout the month.

Broad Market Participation: Beyond the largest platforms, smaller portals such as Honeycomb, SMBX, Vicinity, Climatize, and others each contributed meaningful volume, together representing a healthy long-tail of community and niche-sector capital formation.

Was this Investor Report Helpful?Would you like to see more reports in the future? |

EDGAR Next Deadline: What Investors Should Know

The SEC is requiring all companies that file through EDGAR to enroll in its new authentication system, EDGAR Next. Companies must enroll by December 19, 2025 at 10:00 p.m. ET to avoid losing access to their filing accounts. The SEC has confirmed that late filers will lose access until a new Form ID is approved, which can delay required updates and annual reports.

For investors, this matters because any disruption in a company’s filing ability can create gaps in transparency, slow down due diligence, and signal weak internal organization. Companies that complete enrollment early show stronger operational discipline, while companies that wait may introduce unnecessary uncertainty into their reporting.

To help issuers stay compliant, raisepapers (a Kingscrowd company) is offering free EDGAR Next enrollment assistance. Founders can begin the process by creating an account and visiting the link below.

UPCOMING EVENTS

TODAY’S WORKSHOP WITH JAMES SINCLAIR: FROM IDEA TO PAYING CUSTOMERS

Zero to First Customers: Founder Frameworks That Actually Work

Today at 3pm ET, join serial entrepreneur and founder coach James Sinclair for a live, tactical workshop on validating your idea, designing an MVP, and getting your first paying customers—based on the frameworks from his new book Starting a Startup: Build Something People Want. Live attendees will have the chance to win 1 of 10 copies of the book plus a 1:1 coaching session with James, so this is one session you’ll want to show up to in real time.

Citizens Coffee Investor Q&A Join Kingscrowd Capital and Citizens Coffee CEO Justin Giuffrida for a candid look at channel strategy, unit economics, and the 2026 growth plan—plus live audience Q&A. Save your seat to attend live or get the replay. |

Demo Day Q4 2025 Join us on December 10th for Kingscrowd’s Q4 2025 Demo Day, where top early-stage founders will pitch live and receive expert feedback from Pacaso CLO and longtime Techstars mentor David Willbrand. If you're planning a raise or preparing your next pitch, this is a must-see session to learn what resonates with investors today. |

EVALUATE YOUR STARTUP OPPORTUNITY

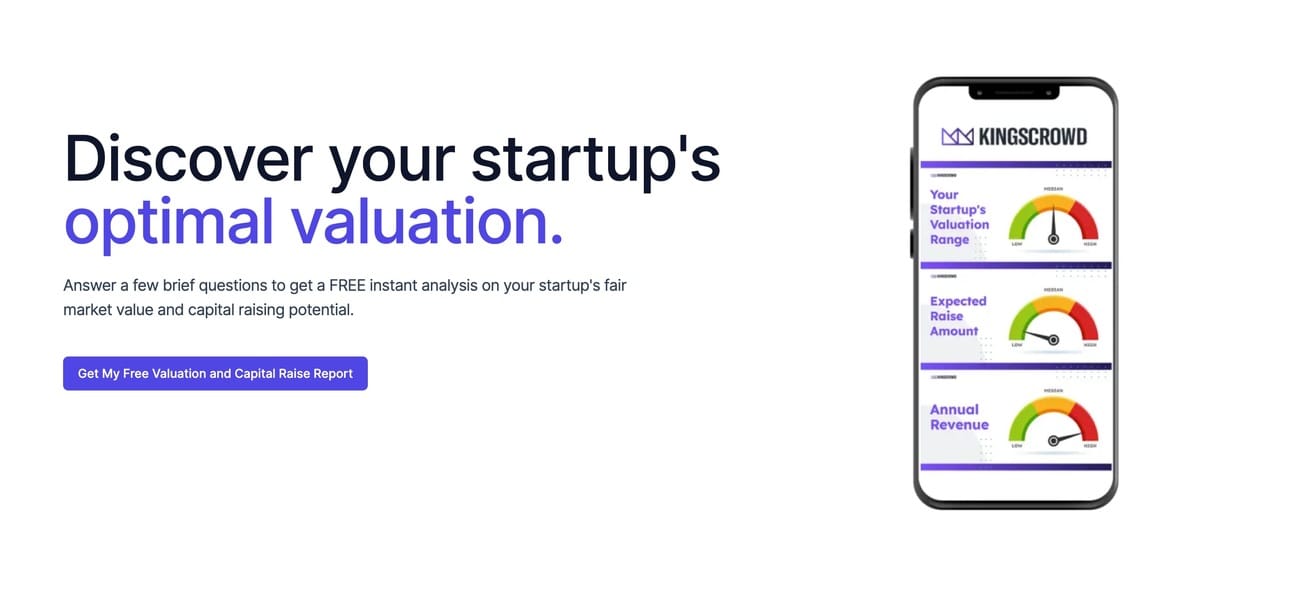

Know Your Company’s Worth in Seconds.

Stop guessing what investors think—get an objective, data-driven valuation in minutes with Kingscrowd’s Startup Valuation Tool. Plug in a few key metrics, see how you stack up against 7,000+ online raises, and walk into your next pitch with confidence. Ready to benchmark your company’s true market value?

INSIDE STARTUP INVESTING

Hemp Seeds, Big Market: Inside Victory Hemp

Category build 101: start with functionality + taste, lock in clean label and North American supply, then scale with a financing stack that fits. Victory Hemp shows how solvent-free processing and zero-waste innovation can turn a niche (hemp) seed into mainstream ingredients.