- Startup Inbox

- Posts

- October Founder Report: Platform Updates & Sector Signals

October Founder Report: Platform Updates & Sector Signals

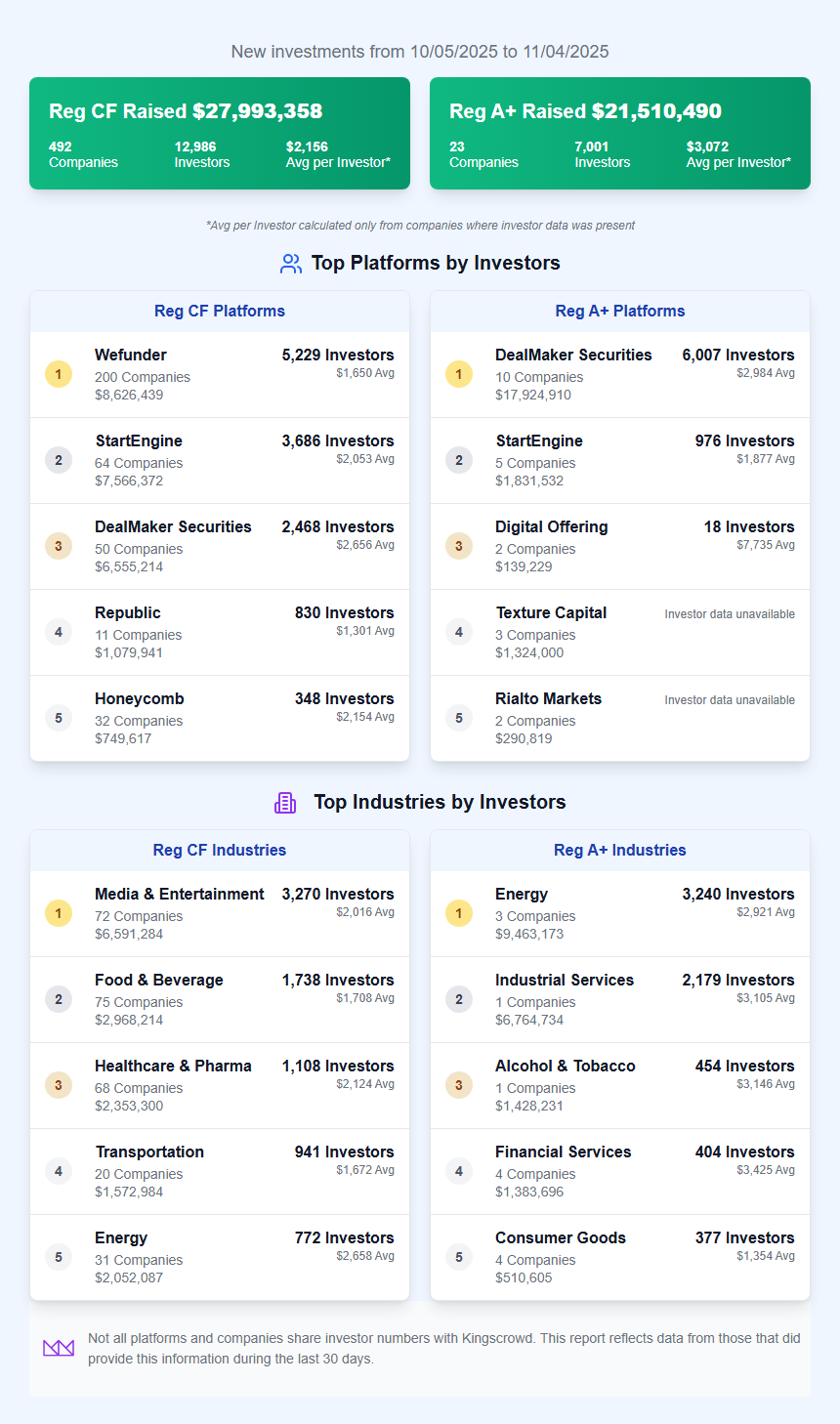

A 30-day market snapshot (Oct 5–Nov 4): $27.99M via Reg CF, $21.51M via Reg A+. See how Wefunder, StartEngine, DealMaker, and others stack up on investor counts and average checks—and which sectors drew the most capital.

October Founder Report

Founder Market Pulse (Oct 5–Nov 4)

The crowd committed $27.99M via Reg CF and $21.51M via Reg A+. Wefunder led on deal count, while StartEngine and DealMaker captured larger average checks. Media & Entertainment topped CF sector dollars; Energy and Industrial dominated A+.

See the platform-by-platform breakdown and how to pick the right shelf for your next raise.

Platform Performance

CF remains top-heavy. The recent “Big 3” in Reg CF—Wefunder, StartEngine, DealMaker Securities—captured the majority of capital over the period, with Wefunder leading on deal count (200 live raises) and StartEngine/DealMaker showing larger average checks per offering.

Wefunder ($8.63M): Breadth strategy; biggest shelf by number of companies (200) and >5.2K investors—great for discovery and community-led momentum. Avg check $1,650; median $1,000.

StartEngine ($7.57M): Fewer offerings (64) but higher avg check ($2,053) and median $1,544—consistent with more curated, higher-ticket raises.

DealMaker Securities ($6.56M): Strong avg check ($2,656) and median ($2,145), reflecting bigger rounds and institutional-style packaging of CF campaigns.

Republic ($1.08M): Smaller total here (11 cos.), but remains a catalyst for marquee or fan-centric deals when activated. Avg check $1,301.

Honeycomb ($0.75M): Community debt/SMB focus; lower absolute dollars but highly aligned for local businesses (avg check $2,154, median $594).

Reg A+ is DealMaker’s home field. DealMaker Securities dominated A+ with $17.9M across 10 issuers, far outpacing other A+ broker-dealers; StartEngine followed at $1.83M across 5. This continues the pattern of A+ dollars clustering in a few scaled distribution pipes.

Sector Highlights: Where Investors Leaned

Media & Entertainment led CF by dollars: $6.59M across 72 companies (avg $2,016), proving (again) that community + IP + fandom mobilize the crowd.

Other notable CF sectors over the period:

Food & Beverage: $2.97M across 75—steady community appetite for tangible brands (avg $1,708).

Healthcare & Pharma: $2.35M across 68—investors back clear problem/solution narratives (avg $2,124).

Energy (incl. climate): $2.05M across 31—continued interest in climate/energy productivity (avg $2,658).

Business Services: $2.52M across 29—high avg check $3,672; B2B efficiency stories travel well.

Alcohol & Tobacco: $2.30M across 36—premium craft and DTC distribution still pull (avg $3,204).

Was this Investor Report Helpful?Would you like to see more reports in the future? |

COMPLIANCE HELPS GROW THE INDUSTRY

Stay compliant. Save money.

At the latest CfPA Summit, SEC Commissioner Hester Peirce just reminded the industry: when issuers skip required disclosures (like Form C-AR), it hurts investors—and it makes regulatory improvements harder to win. If you raised under Reg CF or Reg A, now’s the time to button up your filings.

raisepapers will review and prep your required updates (Form C-AR, Reg A ongoing reports), sanity-check financials, and make sure your disclosures are complete and on time.

Limited offer: Get $200 off compliance services with code COMPLIANCE.

INSIDE STARTUP INVESTING

This Week on Inside Startup Investing: MoviePass CEO Stacy Spikes on Profitable Reboot + Fantasy-Style Movie Gaming

Resurrecting a beloved brand requires a better model. MoviePass pairs sustainable, any-theater subs with Mogul—a knowledge-based game built for retention and margins. Stacy Spikes shares lessons from the $10 era, bringing back profitability, and sequencing a second revenue engine to scale.

EVALUATE YOUR STARTUP OPPORTUNITY

Know Your Company’s Worth in Seconds.

Stop guessing what investors think—get an objective, data-driven valuation in minutes with Kingscrowd’s Startup Valuation Tool. Plug in a few key metrics, see how you stack up against 7,000+ online raises, and walk into your next pitch with confidence. Ready to benchmark your company’s true market value?

CROWDFUNDING REALLY IS FOR EVERYONE: MAKING REG CF & REG A WORK

In this founder-focused read, CrowdCheck CPO Andrew Stephenson shows how both Reg CF and Reg A can fit very different ambitions—from a neighborhood restaurant to a future public company. He spotlights a Reg A case (Newsmax raising $75M pre-listing) and explains how Reg CF can bridge financing gaps as SBA lending tightens—especially for minority- and women-led businesses. Crowdfunding can also coexist with angels/VC, adding customers-turned-investors and momentum beyond the dollars raised.

Founder takeaway: Treat crowdfunding as a strategic channel, not a last resort—pick the exemption that matches your goals, structure for future institutional interest, and lean into your community to convert fans into shareholders.