- Startup Inbox

- Posts

- Welcome to Startup Inbox - Kingscrowd’s New Founder Bulletin

Welcome to Startup Inbox - Kingscrowd’s New Founder Bulletin

Strategy, data & tools for your next raise.

Welcome to Kingscrowd’s first edition of the Startup Inbox! This bi-weekly, founder-focused dispatch will land in your inbox with the resources, data, and community insights you need to raise capital under Reg CF or Reg A, grow revenue, and foster investor trust. Think of Startup Inbox as your shortcut to expert advisory services, real-time market intelligence, and the same diligence engine investors rely on—now tailored for you, the builder behind the raise.

Powered by

Use raisepapers as your one-stop shop for SEC raise compliance. Our templatized forms make getting the proper information in your offering documents easy and an attorney is still there to review, revise, finalize and file to ensure maximum compliance. At a fraction of the cost of others raisepapers makes completing your form filings easy, affordable and compliant. Want to learn more? Book a quick call with Conner.

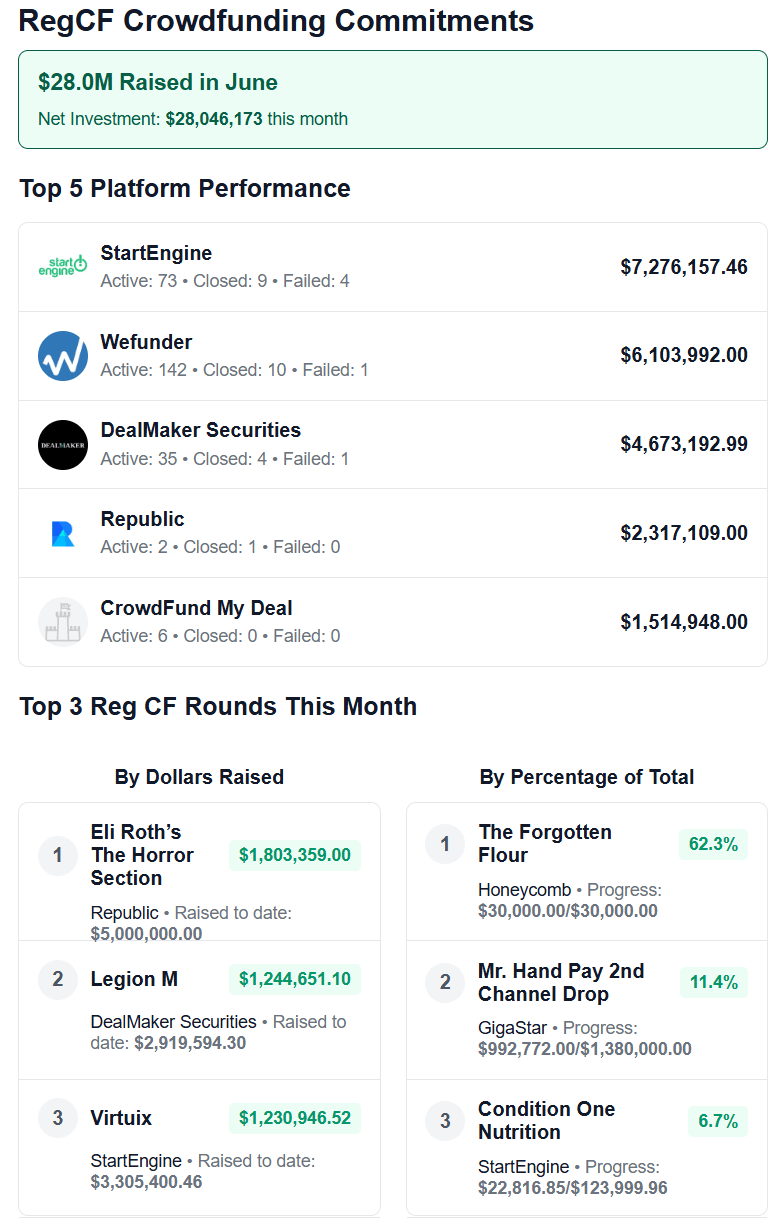

THIS WEEK IN FUNDING

Total capital committed: $28.0 million in net Reg CF investments during June 2025. The big three portals—StartEngine, Wefunder, and DealMaker Securities—captured 64 % of that total.

Active deal flow: Kingscrowd counted ≈ 438 live campaigns across more than 30 funding portals at some point during the month (e.g., 73 on StartEngine, 142 on Wefunder, 59 on Honeycomb, and dozens more on smaller sites).

Outcomes: 51 rounds closed successfully while 18 failed to meet their minimum goals—roughly a 74 % success rate. Portal-level status tallies (e.g., StartEngine 9 wins/4 fails; Honeycomb 12 wins/8 fails) add up to these totals.

Average raise (successful rounds): about $550K (calculated by dividing total net investment by the 51 successful closes).

Largest single raise: Eli Roth’s “The Horror Section” pulled in $1.80 M on Republic, topping June’s leaderboard.

Top-grossing platforms:

StartEngine: $7.28 M raised across 73 active deals.

Wefunder: $6.10 M across 142 active deals.

DealMaker Securities: $4.67 M across 35 active deals.

Seven portals cleared the $1 M mark for the month.

EVALUATE YOUR STARTUP OPPORTUNITY

Know Your Company’s Worth in Seconds.

Stop guessing what investors think—get an objective, data-driven valuation in minutes with Kingscrowd’s Startup Valuation Tool. Plug in a few key metrics, see how you stack up against 7,000+ online raises, and walk into your next pitch with confidence. Ready to benchmark your company’s true market value?

INSIDE STARTUP INVESTING

In this episode of Inside Startup Investing, Chris Lustrino sits down with Dr. Zwade Marshall, founder and CEO of Doc2Doc Lending, to explore how a physician-turned-founder built a fintech company by solving a deeply personal problem — the financial barriers doctors face early in their careers.

Zwade shares how Doc2Doc raised $21M almost exclusively from fellow doctors, built a flexible underwriting model to beat SoFi’s default rates, and scaled to over $100M in originations while staying lean and mission-driven. For any founder tackling industry-specific pain points or looking to raise capital from within a community, this conversation is a masterclass in focused execution and founder-market fit.

UPCOMING EVENTS

Kingscrowd Demo Days put startups in front of hundreds of engaged, active investors exploring opportunities in the private markets. If you're raising capital and looking to stand out, our virtual pitch events offer direct exposure, live Q&A, and support from our expert team. Come check out our Summer Demo Day Tuesday, July 15th to see what we offer. Interested in applying to a future pitch event? Simply reply to this email.