- Startup Inbox

- Posts

- What worked in August: momentum, platform-fit and milestones

What worked in August: momentum, platform-fit and milestones

Hear platform operators at Investment Crowdfunding Week—save your seat.

Presented by

AUGUST INVESTOR REPORT

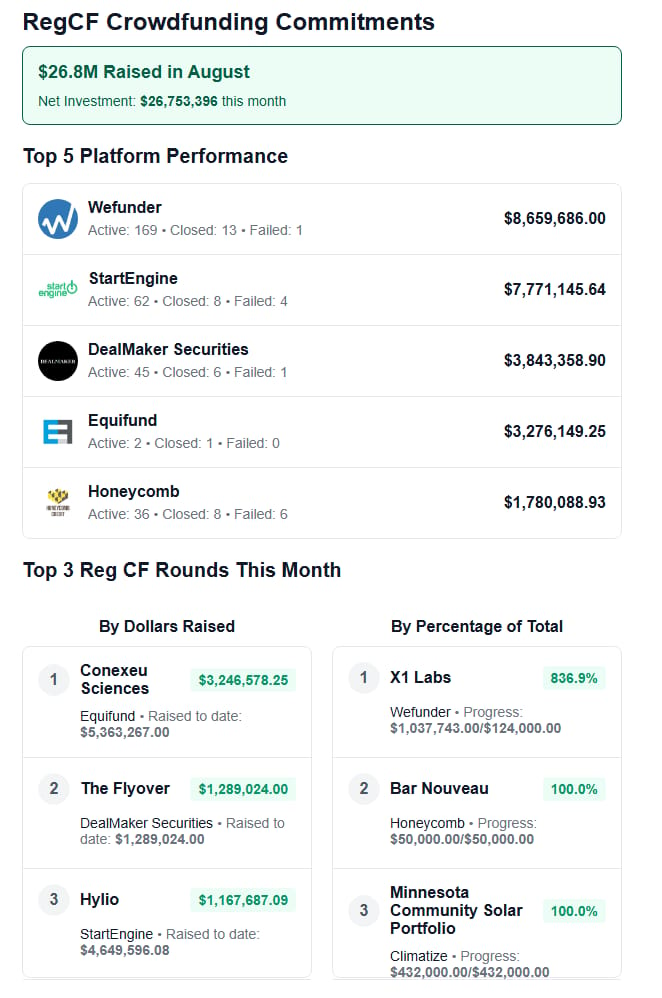

Seasonality & normalization: August’s $26.75M Reg CF tally represents a step down from July’s surge, but it tracks close to last August—suggesting stabilization rather than weakness. Meanwhile, total online capital across regs (~$102M) underscores that Reg A+ carried much of the month’s overall weight, as is common when a few high-profile A+ campaigns hit their stride. See the full breakdown, top raises, and what it means for your next round.

Takeaways for Founders & Platforms

Pre-launch matters most. The August winners either brought built-in audiences (creator tools/media) or compelling traction/tech (life sciences, robotics, climate). Line up evangelists, partners, PR, and social proof before going live.

Design for momentum. Compress announcement moments (press, influencer posts, webinars) into the first 10–14 days. Aim to hit 30–50% of goal quickly—the best signal for follow-on investors.

Consider the full private-markets mix. If you have late-stage signals or larger capital expenditure needs, consider exploring Reg A+—August’s $102M cross-reg total demonstrates how a few scaled A+ campaigns can significantly increase monthly flows.

Was this Investor Report Helpful?Would you like to see more reports in the future? |

RSVP TO INVESTMENT CROWDFUNDING WEEK

RSVP to Investment Crowdfunding Week (Sept 29–Oct 2)

Raise smarter, faster. Kingscrowd’s Investment Crowdfunding Week is a four-day virtual series built to give founders the complete go-to-market for Reg CF and Reg A+. Expect candid playbooks from platform operators, tactical “founder knowledge hours,” and live pitch sessions to see what actually resonates with investors.

Highlights

Keynote: Michael Collins, CEO of Alumni Ventures—on where retail capital is flowing and how founders can position for it.

Best-in-class campaigns: Capital Department has powered campaigns from $0 to millions for standout companies like Siren Biotechnology, BackerKit, and RISE Robotics—this panel unpacks the strategies that made them best-in-class.

Reg A+ fireside: Andrew Stephenson (Crowd Check), Stormer Santana (Dalmore Group) with Chris Lustrino (kingscrowd) on timing, compliance, and distribution that works.

The Full Spectrum: 10+ leading platforms, 40+ startup spotlights across Healthcare, AI/SaaS, CPG, Clean Energy, Sports & Entertainment, and more.

Walk away with messaging frameworks, budgeting tips, and investor outreach tactics you can put to work immediately.

EVALUATE YOUR STARTUP OPPORTUNITY

Know Your Company’s Worth in Seconds.

Stop guessing what investors think—get an objective, data-driven valuation in minutes with Kingscrowd’s Startup Valuation Tool. Plug in a few key metrics, see how you stack up against 7,000+ online raises, and walk into your next pitch with confidence. Ready to benchmark your company’s true market value?

INSIDE STARTUP INVESTING

This Week on Inside Startup Investing

We talk with HEVO CEO Jeremy McCool about building a wireless EV charging platform aligned with UL and SAE standards—and already in development with major automakers, including Stellantis. With bidirectional charging, fleet integrations, and pricing competitive with plug-in systems, HEVO is positioned to scale rapidly as EV platforms launch in 2027–2028. This is a rare deeptech business with a long development cycle—but a sharp scale curve once platforms go live.

FOUNDER EDUCATION

Unlocking the 1%: How Founders Can Attract Larger Checks

Crowdfunding totals have cooled since 2021, but the capital need hasn’t—and the money is still out there. In this practical piece, CrowdCheck founder Sara Hanks argues that retail alone won’t carry your round; you also need allocations from the true 1%—the Buffys and Chads of the world—via their RIAs. The playbook is simple: convenience + confidence. Make it easy for advisors to deploy mandates (“$50K across 10+ common-stock deals in X sector, no SAFEs”) and back it with independent diligence (think CrowdCheck) to satisfy compliance and liability concerns.

Founder takeaway: package your raise for RIA workflows—clean structure (common or preferred, not SAFEs), clear filters (sector, stage), and a third-party diligence bundle—so wealth managers can click “allocate” with confidence.